- Get a job with a large Management/IT consulting company (such as IBM or Accenture) working in that area and have them train you. That's how I got there.

- Get a job with a consulting company specializing in these areas (either a large firm like Towers Perrin or a smaller firm like nGenera). This may be harder to do if you have no experience.

- Look at job boards for interesting jobs. There are often good opportunities posted on dice.com, and monster.com, etc. There are also specialized job boards such as the career opportunities page of World at Work and the Canadian Professional Sales Association's job board.

- If you have business or technical skills, you could look for any job with an SPM Solution Vendor and move into a consulting job.

- Get a related position in the industry; once you have a bit of experience, you can move on to a consulting company.

- Get some experience! Most vendors offer free Webinars, giving a good overview of their products. There are also dozens of books on the topic! If you can afford it, World at Work offer many courses and certifications. SPM software vendors also usually offer training on their products.

- If you are interested with the implementation aspect of ICM/SPM you could learn a Customer Relationship Management package such as SugarCRM. You may never use SugarCRM ever again, but at least it will be something to add on your resume (experience implementing an on-demand CRM software package).

- Participate to my blog, ask questions, build your knowledge.

- Click on my adds (just kidding)

- The most important recommendation last: Network, make contacts. Join a local professional chapter of World at Work or the CPSA... Attend all the conferences you can afford and introduce yourself to everyone you meet and have plenty of business cards to hand out.

- Contact me, I often hear about openings but I don't always have someone in mind to recommend. I may be able to help out and share your resume...

Wednesday, April 30, 2008

How to get an ICM / SPM Job?

Tuesday, April 29, 2008

Sales Compensation Best Practices in the Banking Industry

Last week I attended the Accenture/Callidus Webinar "Industry Banking Best Practices for Maximizing Your Customer Value and Sales Behavior". Below is a summary of some of the information that was discussed. I will leave out Callidus Wachovia's case study for another post and focus on Accenture's point of view.

Last week I attended the Accenture/Callidus Webinar "Industry Banking Best Practices for Maximizing Your Customer Value and Sales Behavior". Below is a summary of some of the information that was discussed. I will leave out Callidus Wachovia's case study for another post and focus on Accenture's point of view.Kirk Coleman, senior executive at Accenture discussed how the Banking industry was facing many issues and challenges. Regardless of the current market situation, customer expectations keep rising. Those who can exceed these expectations will have an opportunity to distinguish themselves from the competition.

Best Practices

- Drive an incentive culture, not a bonus culture

- Focus on the right employees

- Timely delivery of rewards

- Support capability development

- Plan for a journey - not a "project"

- Top performer's pay relative to the market

- Pay dispersion between top and average performers

- Pay and performance correlation

- Alignment of payouts with key financial/marketing objectives

- Variability of incentive compensation year-over-year

- Speads of quota attainment versus plan spread

- Relevance and controllability of performance measures

- Time spend correcting payouts

Kirk noted that behavior of customer facing employees is increasingly important in the banking industry. Developing capabilities across channels is important to avoid improving in one while losing in another.

Another point that Kirk stressed is the importance of timely delivery of rewards. Many banks have quarterly and annual bonus, but in these cases it is difficult for payees to see the relationship between their incentive pay and their behavior. In many cases a monthly incentive strategy would be more appropriate to be able to re-enforce the desired behaviour.

Kirk concluded by saying that Sales Compensation is essential for banks to effectively align sales force behavior with their goals.

I found an additional paper by Accenture "Sales Performance Management: Enterprise Incentive Management from Accenture" which adds some details to the topics covered by Kirk during the presentation.

Monday, April 28, 2008

My Own Press Release: 1000 Unique Visitors this Month!

I would like to take this opportunity to thank you for reading my blog. This is really the only incentive I need to keep writing! The number of unique readers grew pretty consistently since I started blogging in late December and I hope the trend will go on in the months to come.

As some of you reminded me, I will make an effort to keep writing original posts that will hopefully be useful and interesting, rather than regurgitating press releases and PR pitches.

Please keep sending me feedback and ideas of topics which you would find interesting.

Sincerely,

Julien

Callidus Software Launches Operations Center in India

Callidus Software Inc. (NASDAQ: CALD), the leader in Sales Performance Management (SPM), today announced it has opened a new operations center in Hyderabad, India. The center enables Callidus Software to add capacity in the critical areas of product development, consulting services, and technical support through a strategic alliance with Sierra Atlantic, the leader in offshoring enterprise applications and outsourced product development.

Xactly On-Demand Analytics

Xactly Analytics is a new application from Xactly which delivers strong data mining and analytics capabilities, which are easy to leverage by business users and are available through dashboards and reports. It is currently in Beta release and is scheduled for general availability in June 2008.

[Disclaimer: I have not seen Xactly Analytics in action yet and will provide more information when I can]

Xactly Changes the Game in Sales Performance Visibility With On-Demand Analytics

Xactly Analytics stands out as market's first on-demand application enabling visibility into reliable post-sales data to better measure and maximize sales performance.

Xactly Analytics is a fully on-demand, Web-based application delivering a complete range of data exploration and analysis capabilities that would ordinarily require significant time and IT resources to develop. Xactly Analytics provides unified, authoritative views of key sales performance management metrics, including sales incentive analysis, product performance analysis, and sales performance analysis by sales team, product or region. It includes automated data-workflow processes that transform and aggregate business data brought together by Xactly Incent to provide executives, sales managers and finance managers with better visibility into incentive spend that has not previously been possible with traditional Incentive Compensation Management (ICM) products.

Saturday, April 26, 2008

nGenera - The Birth of a new nGen Company

I blogged about BSG Alliance when they purchased Iconixx 2 months ago. Today BSG Alliance was reborn as nGenera, a business innovation platform for Next-Generation Enterprises.

I blogged about BSG Alliance when they purchased Iconixx 2 months ago. Today BSG Alliance was reborn as nGenera, a business innovation platform for Next-Generation Enterprises.Another news which did not get much attention is that BSG Alliance/nGenera recently acquired Ncent, a fully integrated Sales Performance, Bonus and Salary Management software company. The cached version of Ncent website can be found here.

Mark Hall wrote a bit more about nGenera on his blog at ComputerWorld.

Here is more information about nGenera, straight from their website:

We're a different kind of company - built to enable our customers' journeys toward becoming a Next Generation Enterprise - and our innovative core is made of three distinctive capabilities:

- A business platform and components that create an agile mechanism for identifying, creating and configuring our assets

- Collaboration software that enables community-driven innovation (Wikinomics) and interconnects the new global workforce

- An on demand framework that turns Big Ideas into reality for leaders, employees and customers 10x faster than traditional means

Our customers plug-and-play into our platform to enable:

- Revenue growth without additional costs

- Significantly greater utilization of employees and resources

- Breakthrough responsiveness to opportunities & threats

The agility of our platform enables us to configure product offerings directed at our customers' most pressing challenges and opportunities. Currently, nGenera offers three core products:

nGen Leadership gives companies the tools to understand, orient, define and plan their company's transformation into a Next Generation Enterprise. Capabilities include Enterprise 2.0 training, leadership development, management chain automation, strategy on demand and simulation on demand, all powered by Web-based software.

nGen Talent enables enterprises to identify, source and retain key resources anywhere in the world, and to provide an attractive, compelling work environment for the new workforce. Major capabilities include recruiting and on-boarding, learning and development, performance management, total compensation and collaborative culture.

nGen Customer gives companies the means to turn customer insight into compelling, differentiated products and services - to co-create complete customer experiences. Key capabilities include customer experience assessment, emotion mining, community-driven innovation, customer experience design on demand, multi-channel interaction, knowledgebase management, and Web monitoring and analytics.

Wednesday, April 23, 2008

Towers Perrin Announced the Launch of New Compensation Administration Tool

Towers Perrin today announced the launch of an industry-leading, next-generation compensation administration tool with built-in talent management capability, Comp Agility.

Towers Perrin today announced the launch of an industry-leading, next-generation compensation administration tool with built-in talent management capability, Comp Agility.Towers Perrin is a global professional services firm that helps organizations improve their performance through effective people, risk and financial management.

The Comp Agility Suite consists of two modules:Web-based Comp Agility is a complete solution and allows for users around the world to utilize and customize the tool’s content and applications to meet their needs. Job descriptions and competency models can be adjusted to address market and internal considerations, and compensation design can easily be analyzed with region specific data.

Market Analyzer: This Web-based compensation analysis module provides a range of solutions and capabilities, including data storage and review, online benchmarking, a survey data browser, a market-pricing function, a survey submission function and a reporting tool.

Role Analyzer: This Web-based module lets you design and manage information about jobs and job evaluation, manage employee competency assessments, manage your organizational and functional competency models, and produce various workforce distribution reports.

I haven't seen Comp Agility in action nor have I heard feedback from any client yet, but I will provide more information as soon as I do.

Read the full Press Release.

More information about Comp Agility can be found here.

Tuesday, April 22, 2008

Sales Compensation Planning Made Easy - Interview with Makana Solutions

I recently had the opportunity to spend an hour with Liz Cobb, Founder and CEO of Makana Solutions, and with Arthur Gehring, Director of Marketing.

I recently had the opportunity to spend an hour with Liz Cobb, Founder and CEO of Makana Solutions, and with Arthur Gehring, Director of Marketing.Makana is a relatively new company (founded in 2004) offering a very good on-demand application, called Makana Motivator, which helps build effective and clear compensation plans. Makana Motivator is very easy to use and allows its users to quickly create a plan either based on other sample plans, or from the ground up. It also has the capability to “test” your plan.

As I mentioned several times, one of the biggest challenges faced by sales management or consultants when implementing a sales compensation system is the “complexity” of the compensation plans. Sometimes compensation plans are quickly described in a e-mail or over the phone, or almost handed over written on a napkin. In other scenarios, they are can be well documented but may still lack clarity, key aspects, or examples, or may be lengthy. Finally, even if a compensation plan is well documented, it does not mean that the plan is effective and well aligned with the objectives and budget of the company.

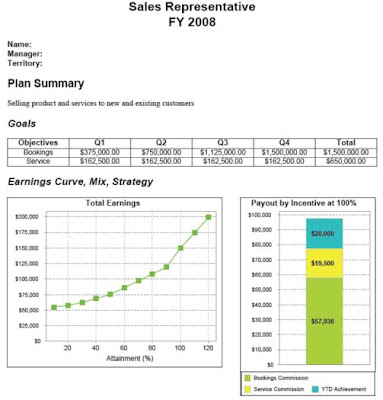

As I mentioned several times, one of the biggest challenges faced by sales management or consultants when implementing a sales compensation system is the “complexity” of the compensation plans. Sometimes compensation plans are quickly described in a e-mail or over the phone, or almost handed over written on a napkin. In other scenarios, they are can be well documented but may still lack clarity, key aspects, or examples, or may be lengthy. Finally, even if a compensation plan is well documented, it does not mean that the plan is effective and well aligned with the objectives and budget of the company.The Makana Motivator application is very intuitive to use. Companies using the application typically receive a 1-hour live tutorial from Makana, after which they are able to model plans on their own. The main components of the application consist of the space in which the plans are built, where the organization is built with assignments and territories (participants can be imported from SalesForce.com), a section for cost modeling the plans, and finally, a section that generates a plan and gives the option to save it as a PDF.

In my opinion, one of the most powerful aspects of Makana Motivator is that it allows users to choose templates from a best-practice library and to adapt them to meet individual circumstances. The application then guides the user following a “wizard” step-by-step approach to ensure nothing is overlooked. The application is very interactive; hovering over most of the application components provides additional feedback . “Blue-ribbon advice” offering expert tips and help is also available throughout the process.

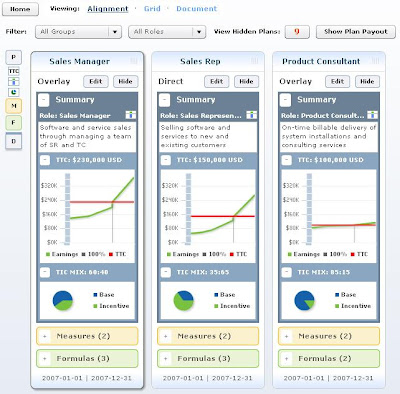

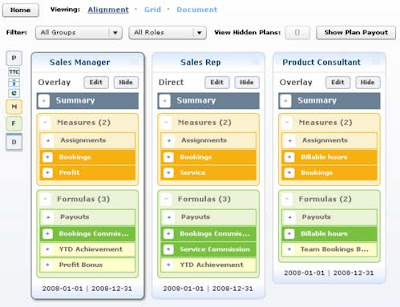

Another important feature of this application is the ability to display and compare plans side by side. Such a graphical representation quickly helps identify the major differences between plans.

Plans are not only displayed side-by-side; they can also be designed and modified side-by-side. Plans consist of measures and formulas which can be edited by expanding their respective section.

The cost modeling section can show costs for the entire company or byany sub-set such as product group or geography. Projected attainment can be modified to gain an idea of the impact of those variables on the overall incentive costs. Many sales performance management applications offer modeling and analytics capabilities, but Makana Motivator allows its users to model the plans BEFORE they are implemented rather than after, which can save a lot of time, money and headaches.

Once the plans are fully designed, and since the application is on-demand; they can easily be circulated and feedback can be gathered directly in the application. Upon acceptance of the plans, plan documents can be individualized and generated. The resulting plans are very clear and easy to understand by consultants, comp teams and sales reps alike, and are visually pleasing.

Motivator adds a lot of value over the spreadsheets used for planning today by streamlining the process, providing best practice guidance, easy cost modeling, clear plans and an audit trail. Makana Motivator also provides Salesforce.com users Apexchange certified integration.

Read more about what customers have to say about Makana Motivator.

Read more about what customers have to say about Makana Motivator.After completing a form on the Makana website, you can access several free webinars and articles about Makana Motivator and compensation plan design best practices.

Monday, April 21, 2008

Do Big Money Bonuses Really Increase Job Performance?

The summary of the paper on the PsyBlog seemed a bit counter-intuitive. Most companies around the world would most likely not have some flavor of a pay-for-performance program if a bonus was actually decreasing performance.

So what is happening? On one hand, I think that if the bonus is very high, participants could have been really stressed out about the task and not performing as well because of that pressure. It is also possible that performance decreased because participants did not actually believe they would receive the bonus for a variety of reasons – sometimes when only a certain number of people can receive the max bonus, participants feel they don’t have a chance to perform at the required level and behave accordingly. Even if there is no maximum number of participants who can receive the largest bonus, the performance required to get the bonus could be perceived as being unattainable or not worth it.

The relative value of bonuses versus the effort required to obtain them is another factor which could affect the participant’s behavior. If working exceedingly hard is required to get the max bonus but that only a moderate amount of work is required to get a bonus which is only slightly inferior, many participants could be settling for the smaller bonus.

I spent some time looking for other papers on this topic and found a few other possible explanations. The “crowding out” theory supports the hypothesis that incentive pay decreases employees’ motivation to perform up to abilities. The explanation generally given for this is that the introduction of an obligatory amount of output to produce is often considered by employees as a signal of distrust. The papers I found discussing the crowding theory are: Titmuss (1970), Rothe(1970), Gneezy and Rustichini (2000), and McNabb and Whitfield (2003). Papers by Kruse (1992), and Ichniowski and Shaw (2003) “prove” that incentive pay positively affects employees’ effort.

As for me, based on my own observations and “empirical evidence”, I will side with Kruse, Ichniowski and Shaw to say that incentive pay (if used properly) can positively affect employees’ performance.

Friday, April 18, 2008

Upcoming Free Webinar: Industry Banking Best Practices for Maximizing Your Customer Value and Sales Behavior

Learn about banking industry best practices from Accenture to ensure that your front line sales people are selling efficiently and effectively - and selling the right products to the right customers. Together with strategies and best practices, you'll also learn how other financial services organizations are using the latest solutions and technologies to optimize these processes, and achieve competitive advantage.

For additional information and to register for the event go to: http://www.callidussoftware.com/go/08/banking-best-practices-to-maximize-sales/

Thursday, April 17, 2008

Spiffs, Bonuses and Contests - Ask the Expert #3

In this 3rd installment of David Cichelli's "Ask the Expert" series on this blog, I asked David about his thoughts on spiffs. I asked him if it was possible to use spiffs while avoiding encouraging employees to push a certain product upon a customer at his or her expenses. I also asked David if there was such a thing as too many spiffs. Previous posts of this series are here and here.

Before going into David's answer, I want to give a bit of background regarding what is a spiff.

SPIF (or SPIFF) may stand for "Sales Performance Incentive Fund", "Special Performance Incentive Fund" or " Special Performance Incentives for Field Force". The exact origin of the term is open for debate. Wikipedia defines a spiff as a small, immediate bonus for a sale. They can be paid by a munufacturer or the employer, to the salesperson who sold a specific product.

I have seen spiffs used in several scenarios such as when a manufacturer wants to gain market adoption with a new product, when a retailer wants to liquidate some of its inventory, to incent sales people to sale certain combinations of widgets, etc. The goal is always to have an immediate impact on sales force behavior. Of course, spiffs are not without their own pros and cons, but they can fit nicely within a compensation strategy.

Here is what David had to say about spiffs:

Julien, you might want to check the spelling of “spiff.” I spell it with one “f.” It means Special Performance Incentive Fund. Check Wikipedia for a nice discussion on the spelling. [Sorry David - I'm sticking to spiff for now, so far I've seen it spelled this way more often than "spif"].

First of all, I consider spifs, contests and campaigns an integral part of the sales management’s tool kit. Here are the rules for appropriate use of these programs:

- Budget of all programs should not exceed the total earnings of the sales force by 3% .

- Spifs should be used for “doing something new for the first time.”

- They should not be used to spike performance during a period.

- They are narcotic in nature: the more you use them the more you need to use them. Moderation of use with healthy hoopla is the best prescription for success.

- Avoid the use of “chance” to determine winners and payouts--it 's unethical to do so: this is an employment relationship, not Las Vegas.

Wednesday, April 16, 2008

Can Performance be Measured?

The article takes the point of view that performance measurement does not work well because typically what is measured is not what matters the most, and that performance often delines when it is measured because once people reach their target there is no incentive to exceed it.

I previously shared some information on performance measurement as well as some personal stories. I agree with John that sometimes quantifiable objectives can be more about office politics and that they can have undesirable effects and he raises a several good points. However, I will say that performance cannot be evaluated without well defined criteria. The article also seems to say that any quantifiable objectives are not as good as less tangible measures, a statement which I can't agree with.

The example of setting set targets also shows what to avoid; In the example, the goal is to answer 90% of inquiries - answer less than 90% and the employee does not get a bonus, answer more than 90% and the employee receives a bonus. This strategy could lead to employees doing the bare minimum of work to reach 90%, but not strive to achieve 100%. If the department's goal was to answer as many queries as possible, a better solution would be to use a quota approach: achieve target and receive a bonus, answer between 90 and 95% of inquiries and receive a bigger bonus, answer between 96 and 99% of inquires and receive an even bigger bonus, and answer 100% of inquiries and get the max bonus. This way, at least in theory, employees will always be motivated to exceed the target.

Choosing "good" performance measures and metrics is one of the most critical aspects of designing an incentive plan, while"bad" measures could result in encouraging undesired behaviors. It is important to know exactly what the desired behaviors and goals are before choosing any measurement. Also, as David Cichelli from The Alexander Group and Liz Cobb from Makana Solutions pointed out earlier, too many measures can ruin a compensation plan by making it overly complex and confusing the payees.

Tuesday, April 15, 2008

Ready... Set... Go-Live!

Before an ICM implementation can be deployed, there are a number of things that need to be done. "Go-Live" refers to an implementation being transitioned from being developed and tested, to being used in production. An application that is "in production" means that it is now used with real data, to pay real people, and bugs, errors and overpayments are not an option.

Meeting the go-live date when building an ICM solution is particularly important because those dates are often related to pay-roll cycles and are often less flexible than other type of systems.

With tight deadlines and little tolerance for mistakes, go-lives are the most stressful moment for anyone involved on the project. No matter how good the relationship with the client and how well the implementation went, if go-live is not successful, executives can get bitter, people can get fired, and all the hard work put in the project can be forgotten.

Implementing different applications require different steps to go live. An on-premise application will have more steps such as migrating the application from the development hardware onto the production hardware and making sure this hardware conforms to the development/test environment. For a SaaS solution there are less steps, migration is usually easier and there is no need to worry about hardware.

What is most stressful for a consultant during the go-live phase is that it's the ultimate milestone; the system must be rolled-out, and the implementation must be completed and functional. The User Acceptance Test (UAT) must be performed on the system and signed-off. UAT is essential to capture the client's agreement that the implementation performs as desired.

With all that is involved in the go-live phase, consultants will work 80-100 hours a week to make it happen; it’s "crunch-time"!

Here are a few ideas of items to include on your ICM go-live check list:

- Setup and test all relevant hardware (if on-premise)

- Ensure updated documentation exists and that users are trained.

- Ensure a roll-back strategy is in place in case there is a ‘show stopper’

- Ensure vendors and consultants are available during go-live period

- Backup any existing configuration

- Install, test and configure all required software, including the creation of a production database

- Migrate all reference data such as order types, credit types, calendars, business groups, users, rolls, etc.

- Migrate all organization data such as positions, titles, hierarchy, territories, customers, relationships, etc.

- Migrate all plan artifacts such as plans, rules, formulas, tables, quotas, etc.

- Migrate any other objects such as reports, draws, documents.

- Ensure any script or data integration items are migrated / updated to reflect the environment change

- Migrate all the required data to the new database

- Test new system rigorously

- Obtain sign-off on results (same results as user testing)

I haven't written on my blog in the past 2 weeks because I am just in the process of going live with 2 projects at the same time, for 2 different clients. Please be patient, I will start writing again soon.

Blog Search

Subscribe

Other Resources

Blog Archive

-

▼

2008

(99)

-

▼

April

(13)

- How to get an ICM / SPM Job?

- Sales Compensation Best Practices in the Banking I...

- My Own Press Release: 1000 Unique Visitors this M...

- Callidus Software Launches Operations Center in India

- Xactly On-Demand Analytics

- nGenera - The Birth of a new nGen Company

- Towers Perrin Announced the Launch of New Compensa...

- Sales Compensation Planning Made Easy - Interview ...

- Do Big Money Bonuses Really Increase Job Performance?

- Upcoming Free Webinar: Industry Banking Best Prac...

- Spiffs, Bonuses and Contests - Ask the Expert #3

- Can Performance be Measured?

- Ready... Set... Go-Live!

-

▼

April

(13)

Tags

- Sales Performance Management (34)

- Incentive Compensation (27)

- Callidus (19)

- Xactly (17)

- Industry News (15)

- SaaS (15)

- Sales Compensation (14)

- Incentive Strategy (12)

- On-demand (11)

- Best Practices (10)

- Centive (9)

- Case Study (8)

- Webinar (8)

- Varicent Software (7)

- Applications (6)

- Compensation Plans (6)

- ICM (6)

- Incentive Compensation Management (6)

- Pros and Cons (6)

- David Cichelli (5)

- IT offshoring (5)

- News (5)

- Technical Tips (5)

- Testing (5)

- Accenture (4)

- Enterprise Incentive Management (4)

- Implementation (4)

- OpenSymmetry (4)

- RFP (4)

- Return on Investment (4)

- Synygy (4)

- Variable Compensation (4)

- outsourcing (4)

- Analytics (3)

- Ask the Expert (3)

- Consultant (3)

- Funny (3)

- Humor (3)

- IT outsourcing (3)

- Information (3)

- Makana (3)

- Performance Measurement (3)

- Procurement (3)

- Research (3)

- SalesForce.com (3)

- nGenera (3)

- Banking (2)

- Bonus (2)

- Compel (2)

- Excel (2)

- Gartner (2)

- Greg Livengood (2)

- Ice-breaker (2)

- Implementation Partner (2)

- Incentive Plans (2)

- Merced Systems (2)

- Offshore (2)

- On-premise (2)

- Opinions (2)

- Personal Story (2)

- Practique Associates (2)

- Review (2)

- SPM (2)

- Sales Resource Group (2)

- SuccessFactors (2)

- Template (2)

- "Canadian Professional Sales Association" (1)

- "Dig your Well before you're Thirsty" (1)

- "Don Tapscott" (1)

- "Effective Dating" (1)

- "Harvey Mackay" (1)

- "Incent 4.0" (1)

- "Jay Somerset" (1)

- "Keith Ferrazzi" (1)

- "Never Eat Alone" (1)

- AskJon (1)

- BSG Alliance (1)

- Benefits (1)

- Blog (1)

- Book Review (1)

- Boutique Consulting (1)

- Bradford Smart (1)

- Business Process Reengineering (1)

- CPSA (1)

- Challenges (1)

- Coaching (1)

- Compensation Architect (1)

- Competency Management (1)

- Configuration Management (1)

- Consulting (1)

- Contests (1)

- Cygnal Group (1)

- Dashboard (1)

- Deployment Checklist (1)

- Donya Rose (1)

- EIM Software (1)

- Effective Dating (1)

- Enterprise 2.0 (1)

- Eran Carmel (1)

- ForceLogix (1)

- Gary Harpst (1)

- Global Workforce (1)

- Glossary (1)

- Go-live (1)

- Greg Alexander (1)

- HCM (1)

- HR Carnival (1)

- ICM Solution (1)

- Iconixx (1)

- In-house Development (1)

- Incentive Compensation Glossary (1)

- Insurance (1)

- Integration (1)

- Interviewing (1)

- Jeff Kaplan (1)

- Job (1)

- Job Evaluation (1)

- Jon Ingham (1)

- Jon Walheim (1)

- Julien Dionne (1)

- KPI (1)

- Leapcomp (1)

- Livengood Consulting Group (1)

- Maintainability (1)

- Management (1)

- Methodology (1)

- Metrics (1)

- Migration (1)

- Motivator (1)

- Naming Convention (1)

- Networking (1)

- Offshore Communication Challenges (1)

- Offshoring Information Technology (1)

- Optimization (1)

- Oracle (1)

- PPM (1)

- Paul Tjia (1)

- Pervasive Performance Management (1)

- Plan Design (1)

- PlanIt (1)

- Prediction (1)

- Press Release (1)

- Professional Networking (1)

- R (1)

- Reporting (1)

- SPM Question (1)

- Sales Performance Management Outsourcing (1)

- Santorini Consulting (1)

- Six Disciplines Execution Revolution (1)

- Spiff (1)

- Sungard (1)

- THINKStrategies (1)

- Talent (1)

- Terminology (1)

- TextPad (1)

- Topgrading for Sales (1)

- Towers Perrin (1)

- TrueTarget (1)

- Truecomp (1)

- Tutorial (1)

- Vendor (1)

- Ventana Research (1)

- Version Control (1)

- Visa (1)

- Wikinomics (1)

- competitive advantage (1)

- sales rep (1)

About Me

- Julien Dionne

- Ottawa, Ontario, Canada

- Julien Dionne is a well-rounded consultant with global business management experience and outstanding technical, business and leadership skills. He earned a Bachelor of Applied Science in Software Engineering from the University of Ottawa, Canada, and he is a member of the Canadian Professional Sales Association. The views posted within this blog do not reflect the views of Julien’s current or previous employers and clients. Julien can be reached at julien.dionne@gmail.com